Insurance Resources

BOP Basics - What's In a Bop?

Learn about the basic parts of a Business Owner's Policy/Package otherwise known as a BOP. You'll learn what they are and who they are generally for.

How Metro Insurance Covers the Toughest Risks

Metro specializes in writing policies for hard-to-write risks, such as high-xmods, businesses with work comp fraud issues, niche industries, excessive claims, hard-to-classify businesses, and others.

Hip Hop Event Supplemental

Fill out this form when you're ready to bind coverage for your hip hop event.

Employee Benefits Liability

Employee benefits liability (EBL) is insurance that covers businesses from errors and omissions that occur when employee benefit plans are administered.

Contractors Pollution Liability Insurance

Contractors, no matter what industry they work in, face environmental risks stemming from operations on a daily basis. For most contractors, a single pollution incident or loss can seriously damage their reputation, operations and even their balance sheet

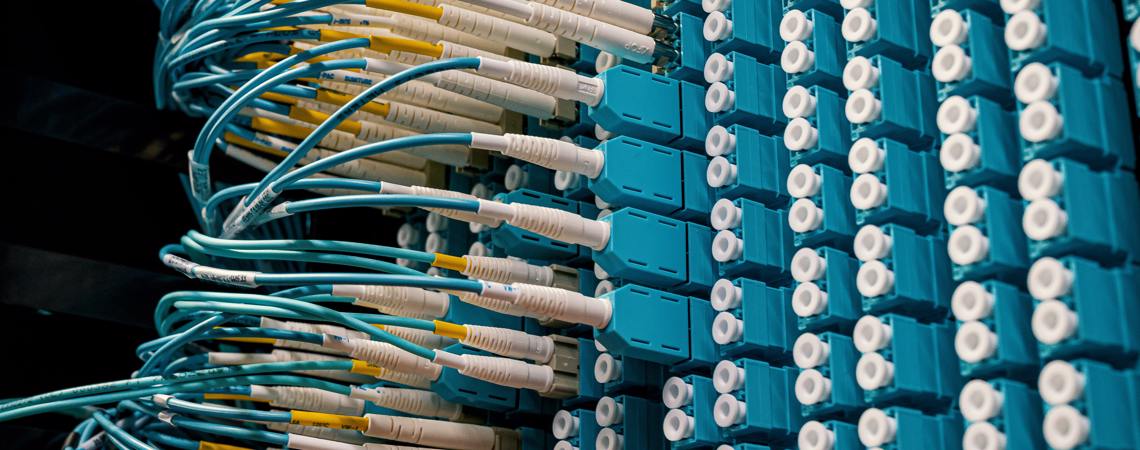

Cyber Risk Exposure Scorecard

Take this quick to determine your risk of exposure for cyber liability. When cyber attacks (such as data breaches and hacks) occur, they can result in devastating damage, such as business disruptions, revenue loss, legal fees, and forensic analysis and customer or employee notifications.

Recommended Insurance Coverages for Software and Game Developers

From pre-packaged developers like game development, to customized services like line-of-business web applications, Metro speaks your language and knows right where to go for the best coverage and pricing.

Tech Insurance Terms to Know

Specialized technology insurance is relatively new and the terminology is still evolving as more claims are handled and new exposures are discovered. Here are some commonly used tech terms in the insurance industry!

Managing Your Total Cost of Risk

As a manufacturer, how do you quantify your true cost of risk? For example, if you are faced with a recall, how do you calculate your loss of reputation or market share?

Lower Costs by Implementing Safety Programs

Across the country, employers pay almost $1 billion per week for direct workers’ compensation costs alone, which comes straight out of company profits. In fact, lost productivity from injuries and illnesses costs companies roughly $63 billion each year.

FSA, HRA and HSA Explained

Know the difference between the different kinds of group medical payments options.

Group Medical Participation Guidelines

This article shows all the different carrier's participation guidelines.

California Health Insurance Mandates and Employment Laws

State health insurance mandates are laws regulating the terms of coverage for insured health plans. Mandates can affect various parts of health insurance plans.

Errors & Omissions Insurance: A Cost-effective Approach to Protecting Your Business

E&O insurance is supplementary liability insurance that enhances any business owner’s policy by safeguarding against catastrophic loss in the event of a lawsuit due to a negligent act, error or omission by the professional. In addition to claims of error, omission, or negligence, E&O insurance can also protect against slander, libel and breach of contract.

Product Liability Insurance

If one of your products harms a customer or other stakeholder in any way, they can sue your business, leading to costly legal fees and settlements that can easily reach six figures. That’s why, to protect against claims and ensure the longevity of your business, you need product liability insurance. Read on to learn all about the real-life applications of this coverage.

Indemnity Agreements and Additional Insured Endorsements

An indemnity agreement secured by an additional insured endorsement is a risk-transfer tool that can help insulate your business from potential risks. Learn more with this informative article.

General Liability Insurance: Your Defense Against Liabilities

The only way to effectively protect the assets of your business is to carry adequate commercial general liability (CGL) insurance coverage. CGL protects your business from damages caused by bodily injury or property damage for which your business is found to be legally liable.

Minimum Auto Insurance Requirements By State

Most states require car owners to buy certain types and minimum amounts of insurance coverage before they may legally drive their cars. This chart shows the mandatory requirements for bodily injury (BI) liability, physical damage (PD) liability, no-fault personal injury protection (PIP), uninsured motorist (UM) and underinsured motorist (UIM) coverage. It also indicates which states have only financial responsibility (FR) laws. Additional information follows the chart.

Common Commercial Auto Terms

There are lots of different terms you should know when in comes to commercial auto insurance. Here's some of the most popular!

Commercial Auto Basics

Learn the basics of commercial auto coverage.

Frequently Asked Questions About Workers' Compensation Insurance

Have questions about worker's compensation? We have answers. This article features the top frequently asked questions about workers' compensation.

Five Strategies for Reducing Workers’ Compensation Costs

Are you taking advantage of these five money-saving strategies? If not, you may be missing a golden opportunity to reduce your workers comp costs.

Worker's Compensation Terms to Know

Check out this list of commonly used workers' compensation terms and their definitions. Learn about common phrases, acronyms, and terms you'll need to know to get a work comp guru.

What Is Worker's Compensation Insurance

This article provides an overview of workers' compensation insurance basics. What is work comp, why do you need it, and what it provides.