Hip Hop and Rap Event Insurance 101

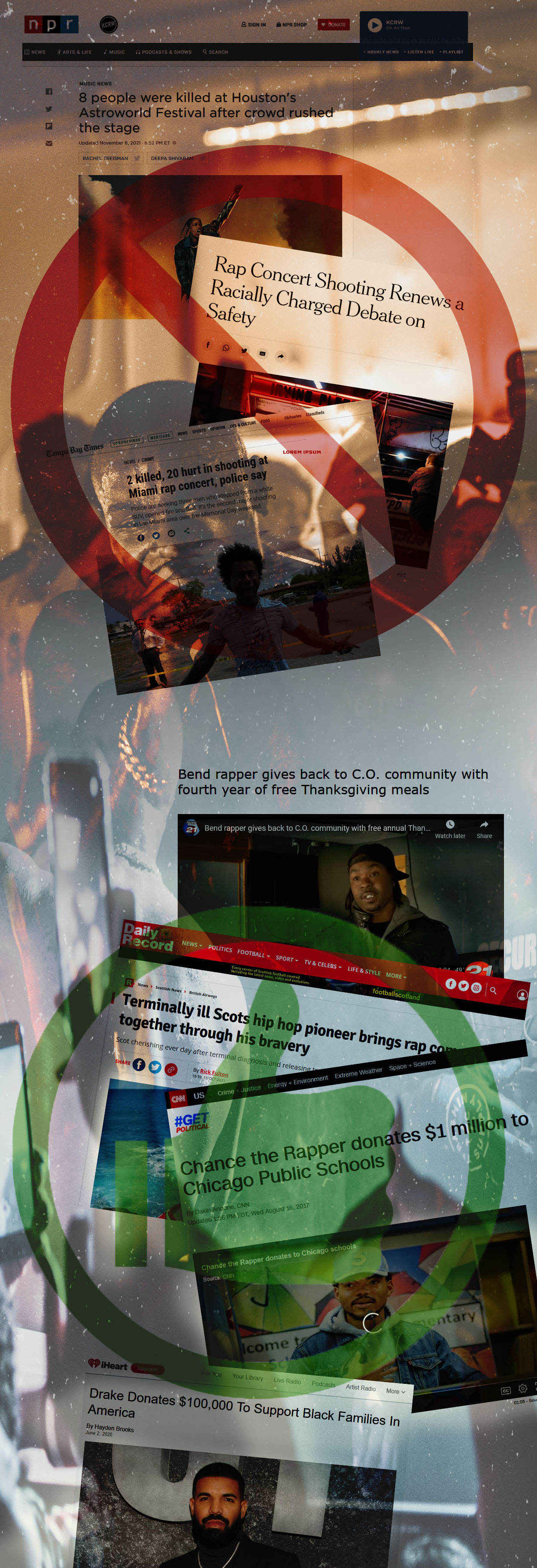

This guide will help you understand the basics of navigating a very specific kind of insurance - Special Event Insurance for Hip Hop / Rap events. Hip Hop and Rap events don't have the best rep. Just recently, 8 people were crushed at an event called Astroworld in Houston due to bad crowd management, a rowdy audience and an allegedly oblivious headliner who exacerbated the problem. Violence and crime is unfortunately a big part of many of acts, and today's underwriters (the guys that effectively set the prices and pick and choose who they will gamble on) do their homework. Metro recently had an applicant where the headlining artist was convicted of fraud for embezzling funds from their promoter and using ticket sales to launder money. We've had several promoters get slammed with high premiums because their headliners have active/open court cases. When artists have a reputation for violence, encouraging bad behavior and news reports get out of fans getting too f*cked up, carriers just won't want to touch the risk. So the first tip in planning insurance for your event, is making sure your lineup's insurance costs are going to be within your budget.

The good news, however, is that underwriters aren't dumb and are in the business of making money. They know the difference between an artist rapping about sh*t for fun, and an artist that has a really bad track record. Remember, an underwriter is effectively placing a bet for millions of dollars that something bad isn't going to happen at your event. So the next thing you're going to want to do is make sure you submit a professional-looking and completed application, along with any materials that make you look good. An impressive website that goes back 10 years showing successful event after successful event makes underwriters comfortable placing the bet. Complete the application using Acrobat and using proper capitalization and punctuation. Presentation means a lot on an application, and I, your broker, am generally not allowed to tamper or change answers on the app unless I know for a fact it's correct / the truth.

The next tip is make sure you submit your app with enough time to allow for processing. This isn't GEICO - quotes aren't generated by an algorithm. Insurance underwriting takes manual effort and time. If you have 100 people at a park with just a few local artists, a week is likely enough time to shop it around and get you a good deal. If you have 50,000 people and ten artists with Jay-Z headlining, it would be in your best interest to submit an application at least a month in advance. This gives me, your broker, time to turn over every rock in the market, and gives the underwriters time to properly underwrite the event. It also gives me time to work with the underwriter on things like shaving down the price or including better coverage... whereas if you're trying to get a policy 72 hours before the event, the underwriter will likely just charge their highest rates (and you'll probably get my highest broker fee as well since I'll have to drop other stuff I'm working on.)

Now let's move onto some more complicated details. The next thing you should do is... educate yourself with what coverages you need, what limits you need and what the different coverages mean. A special event insurance policy may have several different coverages included within it. If you cheap out and get the cheapest insurance policy possible, you may not have coverage that you need when something goes wrong. It's your job to learn what's being required of you, and what you need to protect your assets. Here are some basic insurance terms and coverages you should become familiar with...

Property Insurance

Equipment at events, ranging from complex audio-visual systems to folding chairs, is covered by a property insurance policy, whether it is owned, loaned, or hired for the event. Property is often covered throughout transit to and from the event, as well as during the event itself. Property that has been damaged, destroyed, or lost is replaced on a "new-for-old" basis, which is often not acceptable for antiques, collectibles, or other valuable items. Usually property is NOT covered unless you specifically ask for this coverage. However, a common coverage called "Damage to Premises Rented to You" may cover some things... Many policies will have a limit of, say, $300,000. This means that if someone drives a car into the building out in the parking lot, your policy will cover up to $300k in damages.

General Liability

A special event general liability insurance policy provides wide coverage in the event that an event holder or concessionaire is required to defend itself against lawsuits or pay damages to third parties for bodily injury or property damage. When alcohol is served without the exchange of money, host liquor liability may be included in the policy. Limits and premiums differ significantly based on the sort of event and the location. The liability section of your event insurance policy usually has three limits. "Each occurrence" means that's the maximum dollar amount the policy will pay out per claim or occurrence. Your "aggregate" which simply means the absolute maximum the policy will pay out (you can have up to ten occurrences or ten claims for $100,000 each). Lastly you'll see Products and Completed Operations and also Personal and Advertising Injury. I've linked to some other articles as those coverage are just normal insurance stuff - not related to special events.

Additional Insured (AI)

Your venue will likely require you to add them as an additional insured on your special event policy. Chances are, that's the only reason you're getting this insurance - so that you can give the venue a certificate of insurance with them listed as an additional insured. This simply means that the policy is changed, or "endorsed", to include the venue as an entity that is insured by the policy. Commonly, facilities and venues require that all parties using the site "name them" as an additional insured on a general liability policy. In fact, the wording of the required additional insured endorsement is often included in the insurance requirement section of the facility use agreement signed with the venue. If you signed a contract with a venue, they likely have the AI and coverage limit requirements listed in there.

Liquor liability

This coverage is necessary if you are charging for alcoholic beverages at an event or if a liquor license is required to distribute them. Now this coverage deserves it's own article, because things can get pretty complex and nuanced. What if you hire a licensed, insured and bonded bartender - or what if the event is handling the liquor - or what if you allow liquor but you aren't selling any at the venue? Just remember that you may be held liable during the course of an event by reason of:

- Causing or contributing to the intoxication of a person

- Furnishing alcoholic beverages to a person under legal drinking age or under the influence of alcohol

- Violating any statute, ordinance or regulation relating to the sale, gift distribution or use of alcoholic beverages.

Cancellation Insurance

Similar to business interruption insurance in other industries, cancellation policies are essential to preventing serious financial consequences in case of an event’s cancellation. These policies can be useful even when the event is not entirely cancelled, expenditures due to unforeseen circumstances (such as alternate forms of transportation to the event during inclement weather) are generally covered as well. The policy generally covers all perils that are beyond the control of the event’s host, including inclement weather, a speaker dropping out, strikes or disease outbreak. In some cases, the same policy can cover multiple events. Policies are less expensive if they are purchased far in advance, and premiums range depending on the time of year, the type of event and the level of environmental risk in the surrounding geographic area.

Just a Few More

A third-party property damage liability policy pays for damage, destruction or loss of property belonging to others while it is in the care, custody or control of the policyholder. Contractual liability is a legal obligation voluntarily assumed under the terms of a contract, as distinguished from liability imposed by the law (legal liability). Automobile liability coverage pays for damages resulting from the ownership, maintenance or use of a covered auto are covered by an automobile liability policy. This liability arises whenever you or someone working for you employees leases, hires, rents or borrows a vehicle for business reasons. If you will be using a car and loaning it to others for the event, you'll want to consider this type of coverage - it's pretty cheap. Workers’ compensation coverage provides for medical, disability or death benefits to an employee who becomes ill or who is injured in the workplace. This is required by California state law. So even if you just have friends working for you - you may want to add this coverage in case they get hurt. There's also employer's liability, sexual harassment, and a bunch more - but we'll cover those another time.

You're almost a hip hop / rap special event insurance specialist. Just a few last things to keep in mind.

Right next to the list of performing artists as key pricing indicator, is of course, your crowd size. When you fill out your application, you'll be asked to provide some numbers to give the underwriter an idea of how populated the event will be - how many tickets did you print or what is the max # of seats, how many have you sold so far, and how many do you expect to sell. Be conservative with your numbers. I like to tell people "hey I know I'm going to do X otherwise I wouldn't even be throwing this event." The underwriter will look at your promotional material, the venue's website, social media, etc. to ensure the numbers are accurate. Some policies are subject to audit as well - so if you write 5,000 attendees on your application, but end up having 50,000 - well, you better hope you don't have a claim. Make sure you have professional promotional material online by the time you submit your application and carriers will always rest easier knowing you have a track record of throwing lots of past successful events. So put your best foot forward where you can.

Other Pricing Factors

Other important pricing indicators are your gross revenue, event location, and what security measures you will put in place. Most insurance carriers will want metal detectors for ALL guests and artists. Many will want at least 1 guard per 100 guests - so take that into account. And when you attest to something in writing - you risk having your claim denied if you don't follow through. We had an insured recently who filed a claim when one of the guests was stabbed by another guest. After filing a claim, it came to light that the promoter did not have metal detectors at the event, even though they claimed the did on the application. Don't give the carriers a reason to deny your claim! You never know when you're going to need your insurance.

In Conclusion Hip Hop / Rap is one of my favorite genres. I was a DJ for several hip hop groups in the late 90s (pictured right, I'm in the back behind the decks) and I have a real love for the music and the scene out here on the west coast. It's really unfortunate that this genre has gotten singled out for being "high risk" when it's just the same as any other kind of music - there's always some bad apples in every bunch - but follow my guide and you'll be in the best position possible to get good and affordable coverage.

Hip Hop / Rap is one of my favorite genres. I was a DJ for several hip hop groups in the late 90s (pictured right, I'm in the back behind the decks) and I have a real love for the music and the scene out here on the west coast. It's really unfortunate that this genre has gotten singled out for being "high risk" when it's just the same as any other kind of music - there's always some bad apples in every bunch - but follow my guide and you'll be in the best position possible to get good and affordable coverage.