Distracted Driving Policies for Your Businesses

Distracted driving occurs whenever you engage in an activity behind the wheel that takes your attention away from the road. Such actvities can include using your cellphone, eating, drinking, plugging information into your GPS or adjusting the radio. Think distracted driving isn’t a serious concern? Think again. According to the National Safety Council, more than 700 people are injured each day as a result of distracted driving crashes. Keep reading to learn what you can do to reduce potential distractions while you drive—keeping both yourself and others safe on the road.

This article is divided into two parts - tips your should be reinforcing at all times, during trainings, etc. and how a "Distracted Driving" company policy can help you improve employee driving habits and general safety.

Tips for California Distracted Drivers

- Avoid talking on your cellphone or texting while driving.

- Never touch up your makeup or hair in the rearview mirror.

- Limit your conversations with passengers and ask them to keep their voices down so you can concentrate on the road.

- Don’t smoke while you are driving, as you will probably pay more attention to not burning yourself or putting out the cigarette than driving safely.

- Only adjust the radio when you are completely stopped.

- Never allow animals to sit on your lap while driving.

- Don’t eat or drink while driving.

Avoid reading maps or directions as you drive. Instead, pull into a parking lot to get your bearings and determine where you need to go next to reach your final destination.

Make the Road Your Sole Focus While Driving

Allowing yourself to become distracted while driving can lead to dangerous, and even fatal, consequences. Be a responsible motorist and make paying attention to the road your number one priority when you’re behind the wheel.

Every Business Needs a Distracted Driving Policy

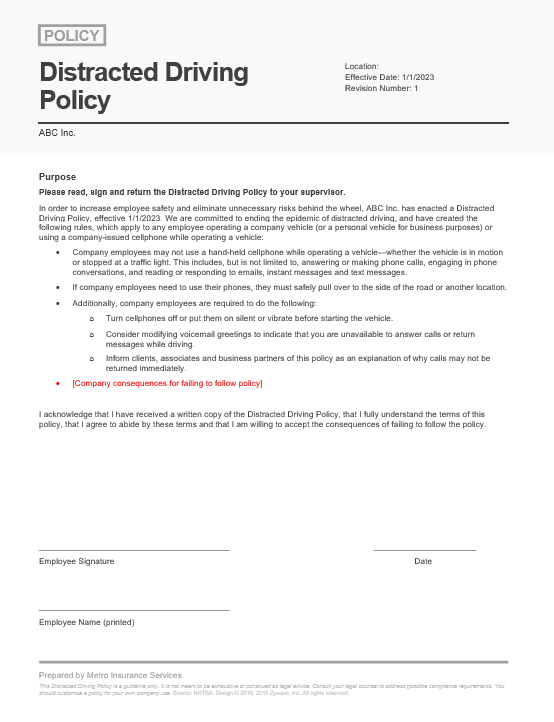

Implementing a Distracted Driving Policy for your business is a crucial step towards promoting safety and reducing potential liabilities. Holding a meeting to discuss the new policy with all employees can ensure that everyone is on the same page and understands the importance of adhering to the policy. Every employee should sign the document, and the signatures should be kept on file as proof of compliance. The policy should be updated regularly and communicated to all employees.

Such a policy is essential because distracted driving has become a leading cause of accidents on the road. By prohibiting activities like texting or using a cell phone while driving, businesses can reduce the likelihood of accidents and protect their employees. Additionally, having a Distracted Driving Policy in place can lead to lower insurance premiums, as insurers view businesses with policies promoting safety as less risky to insure. By implementing a Distracted Driving Policy, businesses can protect their employees, reduce liabilities, and potentially save money on insurance costs.

We Make It Easy to Implement

Metro Insurance offers a free and customizable template for businesses looking to implement a Distracted Driving Policy. This template can be tailored to fit the unique needs of any business, and it's an excellent starting point for creating a comprehensive policy that promotes safety and reduces liabilities. All businesses need to do is ask, and the template will be provided free of charge. By using Metro Insurance's template, businesses can save time and resources in creating their policies and be confident that they have a strong foundation for promoting safe driving practices among their employees.

Metro Insurance offers a free and customizable template for businesses looking to implement a Distracted Driving Policy. This template can be tailored to fit the unique needs of any business, and it's an excellent starting point for creating a comprehensive policy that promotes safety and reduces liabilities. All businesses need to do is ask, and the template will be provided free of charge. By using Metro Insurance's template, businesses can save time and resources in creating their policies and be confident that they have a strong foundation for promoting safe driving practices among their employees.